Share Kya Hota Hai? - Kisi Company Me Share Ka Kya Matlab?

Hello Dosto Aaj ka yah article Share Kya Hota Hai? - Kisi Company Me Share Ka Kya Matlab? ispar adharit hai, jisme hm Share se judi sari information janenge.

|

| Share Kya Hota Hai? - Kisi Company Me Share Ka Kya Matlab? |

For Example - Share Market me Share ka kya matlab hota hai?. Koi bhi Company apna Share q banati hai or fir us share ko q bechati hai?. Company apna Share banane ke liye kya karti hai?.

Read Also - Option Chain क्या होता है? Share Market में Option Chain क्या होता है?

Kisi company me Share ka kya matlab hota hai?. Company me Share khridne(Buy) ya bechane(Sell) karne ka kya matlab hota hai?.

Share kharidna kyo jaruri hai?, Kya Share kharidna chahiye?, Kisi company ke Share khridne se hame maximum or minimum kitna profit or loss ho sakta hai?. Kisi company me share kaise khrid sakte hai?. Company apna share kyo bechati (sell) hai?.

Agar aap Share Market me naye hai ya abhi learn kar rahe hai

to zahir hai ki aapke man me Share Market ko lekar yahi sare sawal aa rhe honge.

Agar aap apne carrier ko lekar serious hai, or Share Market

me apna carrier banana chahte hai. Ek Trader ya Invester banna chahte hai to,

welcome hai aapka mygyanupchar website par.

Jhan par aapko biggner se Share Market ke A to Z jankari. Basic To Advance course se related helpfull content Article ke fom me mil jayenge.

Wo bhi bilkul FREE me Jise read karne par. Aap bhi ek Successful Trader

ya ek Successful Invster ban payenge.

Aaiye ab hm sabse pahle yah jante hai ki akhir Share Kya Hota

Hai?

Share Kya Hota Hai?

Share ka matlab kisi bhi company me hissedari se hai. dusri bhasha me hm kisi company ke net capital ke smallest part

ko share kah sakte hai.

Kisi Company Me Share Ka Kya Matlab?

Share kya hai ya share kya hota hai ise acche se samajhn ke

liye hm ek example ki help lenge, taki hm asani

se share ke bare me jan paye.

For Example – Koi do log, Mr. Shivam or Mr. Suraj, milkar

kisi company ko start karte hai, jisme company ka name SS Private limited rakha

jata hai, or yah company Milk ka production karti hai, sath he milk se related

kai product ka bhi production karti hai, jaise ghee, butter, paneer Etc.

SS Private limited

company ko start karne ke liye Mr. Shivam or Mr. Suraj ne 50 - 50 lakh rupay

lagaye. Jisse company ki total net value 1 crore ho gai.

Kyo ki present time

me SS Private limited company ko start karne ke liye Mr. Shivam or Mr. Suraj ne

he apne 50 – 50 lakh rupiye lagaye hai, isliye abhi is company ke total 2

partner he hai. (

Ab company start hone

ke 5 year ke baad, jab log is company ke sabhi product jaise ki – Milk, Ghee,

Curd, Paneer, Etc. ko pasand karne lag jate hai.

To aise me q ki log

is company ko or is company ke product ko bahut he jyada pasand kar rahe hai,

jisse ki overall pure state me or market me is company ki demand day by day

badhatee he ja rahi hai.

Ab company ki

badhatee growth ko dekhate hue, company ke founder (Mr. Shivam or Mr. Suraj)

ne company ko India ke 28 states me bhi extend karne ka plan banaya. Jiske liye

company ko total 100 Crore rupiye funding chahiye hogi.

India ke 28 states me

company established karne ke liye land, cow, dairy farm construction, multiple

vehicle, generator startup etc banana ke liye company ko total 100 crore

capital ki need hogi.

SS Pvt Ltd company

apne growth or time ke mutabik abhi bahut he accha Profit gain kar rahi hai.

Lekin abhi jis hisab

se company profit kama rahi hai, us hisab se calculation karne par yah company

aane wale 1 years me Breakeven par aa jayegi.

(Note – Abhi is

company ke do he partner hai)

To iska matlab yah

hua ki current time me company ke profit ke paise se, India ke dusre state me

company extend or start karna possible nhi hai.

Or sabse badi baat yah hai ki company ke in

dono partner ke pas bhi itne paise nhi hai ki wah is company ko 28 state me establish

kar paye.

Ab aisi condition me agar

company ko india ke 28 state me apna startup extend karna hai to iske liye

company ke pas ya yu kahe to company ke partner ke pas only 2 method he bachate

hai, first hai Bank se Loan lekar and second hai, company ke share ko bech kar.

Bank se Loan lekar company ko bada karne ka concept common hai, or qki jab bank kisi company ko uske development ke liye loan deti hai.

To aise me bank us company ke total value,

profit, net value jaise or bhi kai factor ko dekh kar ek nicchit rashi (certain

amount) he loan ke roop me bank company ko deti hai, wo bhi acche khase Interest Rate par.

Lekin yahan baat 100

Crore ki hai, isliye koi bhi bank is company ko itna bada amount loan nhi dengi

qki SS Pvt Ltd company ka total net value he around 1 crore ke aas – pass hai.

To wahi SS Pvt Ltd

company jiski net value he abhi 1 crore hai, or bank se 100 crore loan ki

demand kar rahi hai, aise me kisi bhi bank ko itna bada amount kisi company ko

loan ke roop me dena possible nhi hai. Khas kar tab jab company apne initial

stage me perform kar rahi ho.

Ab aise me SS Pvt Ltd

company ke dono business partner Mr. Shivam or Mr. Suraj ke pas ab ek he option

bachate hai, or wah hai company me jyada – se – jyada invester or business

partner add karna.

Company ke do business partner Mr.

Shivam or Mr. Suraj ke pas already is company ke 50 – 50 % hissedari hai, jo add

hokar 100% hissedari ban jati hai. Aisa kahana galat nhi hoga.

Ab qki company ko

jiski total net value present time me 1 crore hai, jise 100 crore banana hai,

taki company apna startup India ke 27 states me build kar sake, to iske liye

jyada – se – jyada invester or business partner ki need hogi.

Ab aise me yahi par share ka concept aa jata hai, jisme ki SS Private limited company ke total capital ko kai smallest

part me divide kar diya jata hai. Jise share kaha jata hai.

Aaiye ab hm share ko

or bhi simple language me samajhne ka try karte hai, or sath me hm yah bhi

janenge ki kisi new company me share kaise banta hai. Or kaise kisi company ke

net capital ko multiple share me or smallest part me divide kiya jata hai.

Example ke liye hm

yahan SS Private limited company ko he lenge.

SS Private Limited

Company ki shruat do business partner Mr. Shivam or Mr. Suraj ne apne 50 – 50

lakh rupe lagaye, jo milkar 1 crore ho gaye.

Isliye abhi is

company me partner bas ye dono he hai. Lekin qki inhe apni company ko bada

karne ke liye 100 crore rupe ki funding chahiye. To aise me inhe apne company

ke liye koi partner ya invester chahiye.

Iske liye ek aisa

system hona chahiye jisse ye easaly naye logo ko apni company me partner or

invester bana paye.

Ab kisi company me

share ka system ek aisa he system hai. Jisme log company ke share ko buy or

sell kar ke khud profit kamate he hai or isse us company ko bhi fayda hota hai.

Company ke share ko

banana ke liye us company ko kuch parameter me rakha jata hai, jisse ki company

ke hajaro ya lakho share banaye ja sake.

Jaise ki company ka

malik koun-koun hai, company ki net value kitni hai, company me koi kaise

invest kar paye.

To ye sab chejo ko saral

karne ke liye, company ko chote – chote part me divide kar diya jata hai. Jise

hm Share kahate hai.

New Company Me Total Kitne Share Hote hai?

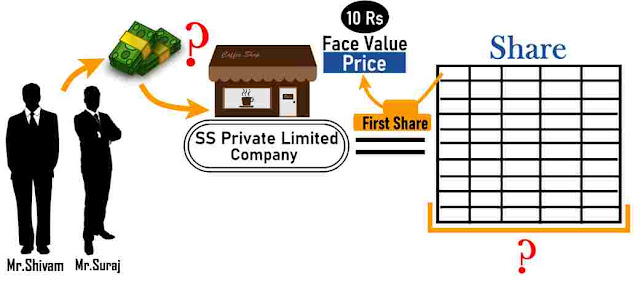

Kisi Company Ke Share Me Face Value Kya Hota Hai?

Jab koi new company

banti hai to us time company ke first share ko us company ka Face Value bola

jata hai, jiski kimat karib 10 Rs hoti hai.

Ek baat or ki company ke ban jane ke baad, in future agar company ke share ki price badhatee hai ya ghati hai to iska impact company ke face value par bilkul bhi nhi padata hai.

Or na he kisi company

ki face value kabhi badhatee hai, yani kisi company ko banate time agar us

company ke first share jise hm Face Value kahate hai, agar iski kimat 10 rs hai

to wo lifetime 10rs he rahege.

Aaiye ab hm samajhte

hai ke, Company ke share kaise banaye jate hai. Taki new partner or invester

company me easaly apna paisa invest kar paye.

Company Ke Share Kaise Bante Hai.

Jaise ki hamne upar

padha ki SS private limited company ko banane ke liye inke founder (Mr. Shivam

or Mr. Suraj) ne apne 50 – 50 lakh rupe lagaye. Jise add karne par total amount

1 crore rupe hote hai.

To hm yah kah sakte

hai ki company ke founder ne company start karne ke liye total 1 crore rupe

lagaye hai.

Ab agar hm 1 crore

rupe ko 10 rupe ke share me batenge to total 10 lakh share banenge. Yani puri

SS private limited company ab total 10 lakh share me bat chuki hai. Aisa kahana

galat nahi hoga.

Ab company ke 10 lakh share unhen he milenge, jinhonne

company me apne paise lagaye hai, yani Mr. Shivam or Mr. Suraj ko.

Company me Mr. Shivam

or Mr. Suraj ne apne 50 – 50 lakh rupiye lagaye hai, jiska matlab yah hua ki

dono ke pas company ki 50 – 50 % hissedari hai.

Or is karan se dono

partner ko company ke total 10 lakh ke share ka 50 – 50 % hissa milega, yani ki

Mr. Shivam or Mr. Suraj ko 5 – 5 lakh share milenge. (jisme ek share ki kimat

10 rupe hai)

Ab qki 1 share ki

kimat 10 rupe hai, jise agar hm thodi calculation kare to 5 lakh share * 10

rupe = 50 lakh share hote hai.

Isliye hm yah kah

sakte hai ki dono partner ko 50 -50 lakh ke share mile hai. Jo unke lagaye hue

rupayo ke barabar hai.

Qki yahan par puri SS

Private Limited Company ab 10 lakh share me bati hui hai, to hm yah kah sakte

hai ki total 10 lakh share company ke 100% ke barabar hai.(10 Lakh Share =

100%).

To is hisab se

company ke keval 10 hajar share company ke 1% ke barabar honge, .(10 Thousand

Share = 1%). Aisa hm kah sakte hai.

Ab agar mujhe SS

Private Limited Company ke 1% share ko khrid kar is company me 1% ka business partner

banna hai. Jiske liye mujhe is company ke 10 haja share ko Buy karna hoga, Jo ki

company ke 1% ke equal hai.

To aise me mujhe is

company ke 10 hajar share ko buy karne ke liye total 1 lakh rupe is company me invest

karne honge, qki yahan par ek share ki kimat 10 rupe hai to is hisab se (10

hajar share * 10 rupe = 1 lakh) amount invest karne honge.

Tab jakar hm Mr. Shivam or Mr. Suraj ki banai Company SS Private Limited ke 1% share ke malik ban payenge. Aisa kahana kuch galat nhi hoga.

Mai ummid karta hun ki abhi tak aapne article pura read kar liye hoga. Aaiye ab hm Share se judi kuch quarry ke answer ko jante hai.

Share se related jyadatar quarry ke answer aapko artice me reading karte time he mil gaye honge. Lekin aaiye hm sare ke baar me apna concept ek baar fir se clear kar lete hai, Kuch Quarry ke answer ko jankar.

Company apna Share q banati hai?

👉Company apna share q banati hai or fir q sell karti hai, iska answer ek he hai. 👉 Koi company apna share tab banati hai, jab us company ko growth ke liye bahut he jyada funding ki, yani ki bahut jyada paiso ki jarurat hoti hai.

Jitne jyada Log interested hokar kisi company ke share ko Buy karenge, Utna he jyada profit us company ko hoga.

jisse ki company time to time accha - khasa growth karegi, Or company ke share ke price me bhi ijafa dekhane ko milega.

New Company Ko Apna Share Sell Karne Ke Liye Kya Karna Hota Hai?

👉Jab koi New Company apne share sell karna chahthi hai, To aise me sabse pahle company ko apne share ko IPO (Initial public offering) ke thru Stock Market me lana hota hai.

Basically IPO ek system hai, jiske thru New Campines apne share ko Stock Market me registered karvati hai.

Jab IPO ke thru koi company pas ho jati hai, to uske baad he wah company apne share ko Stock Market me Sell kar sakte hai.

Mai Kisi Company ke Share Kab Buy Kar Sakta hun?

👉Koi investor ya business partner kisi company ke share ko tabhi Buy kar sakta hai, jab wah company Indian Stock Market me registered ho, or company apne share ko sell kar chuki ho. (Example ke liye - Tata Power Share, Reliance Share, Adani Share) Etc.

Company Ke Share Ko Khridne Se Kya Hota Hai?

👉Company ke

share ko khridne se Profit or Loss dono he ho sakta hai, Qki kisi company ke

share ko khridne se Profit hoga ya fir Loss hoga, yah is baat par depand karta

hai ki.

Company ki overall

performance kya hai. Company kitni purani hai, Company jis time bani thi, to us

time company ka kya growth tha, present time me company ka kya growth hai. Or

aane wale time me company ka kya growth hone wala hai.

Conclusion -

I hope Guys ki aapne

article pura read kya ho, jisse ki aap ko Share ki A to Z information

mil gai hogi.

Is article me hamne Full

detail ke sath share kya hota hai? iski explanation ki hai,jisme hamne multiple

example ko bhi liya hai.

Guys agar aap ko yah

article helpful laga ho to aap hame niche comment me apna Feedback jarur de.

Thanks

Please do not enter any spam link in the comment box.